Governance

- Basic Viewpoint

Concerning Corporate Governance - Directors/Audit & Supervisory Board Members

- Evaluation of

effectiveness of the Board of Directors - Nurturing the Next Generation of Management

- Executive remuneration

- Policy on Strategically Held Shares

Basic Viewpoint Concerning Corporate Governance

We recognize that enhancing corporate governance is one of the most important management issues as a foundation for the KANADEN group to realize sustainable growth, increase corporate value over the medium to long term, and fulfill its responsibilities to its diverse stakeholders. Based on this basic approach, we are working to enhance our corporate governance system.

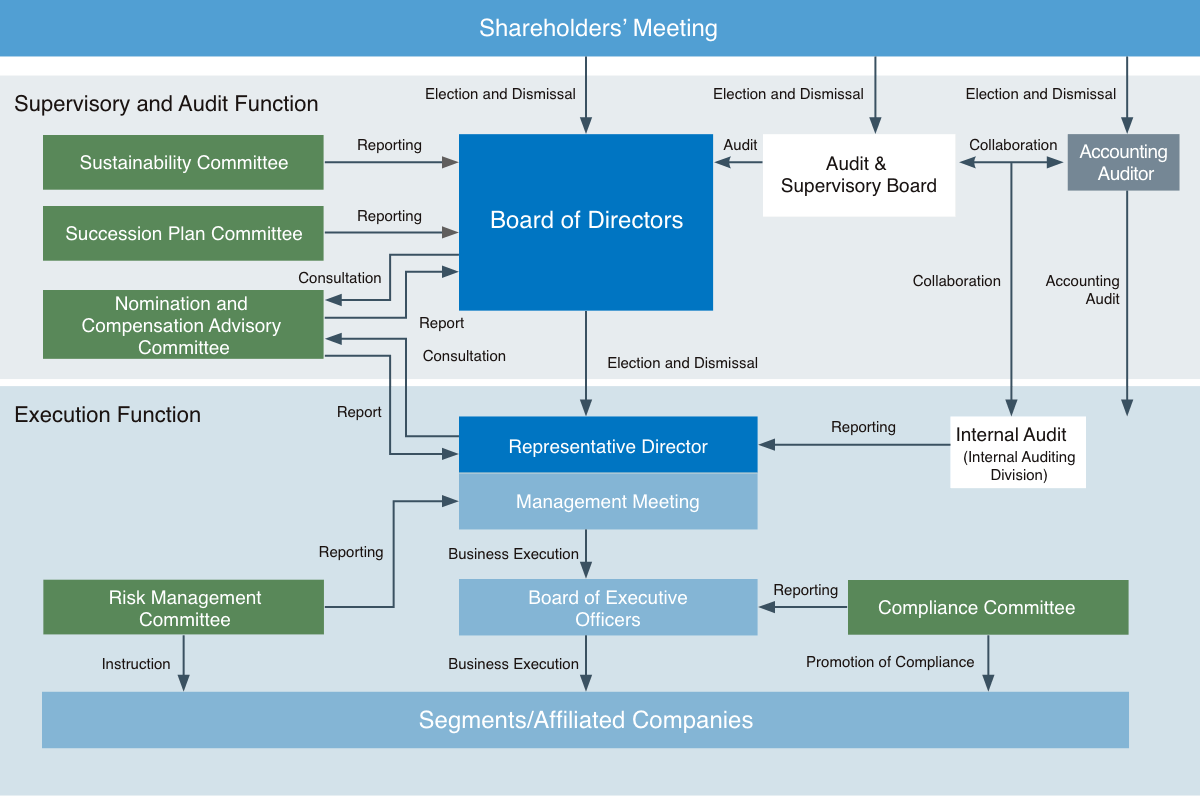

Corporate Governance System

-

The Board of

DirectorsChairperson Futoshi Moriya

Number of meetings held during FY2024: 13

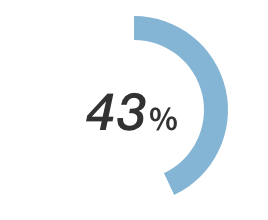

Attendance rate during FY2024: 100%Ratio of Outside Officers

The Board of Directors consists of seven Directors, including three Outside Directors, in order to ensure swift and appropriate managerial decision- making. It holds ordinary board meetings each month and extraordinary board meetings as needed. In addition, we are increasing the opportunities to be able to grasp information related to topics through having Outside Directors participate in the meetings of the Board of Executive Officers and holding forums for facilitating information exchange.

-

The Audit & Supervisory Board

Chairperson Kazuhiro Tsukada

Number of meetings held during FY2024: 6

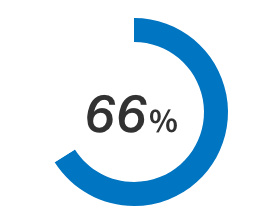

Attendance rate during FY2024: 100%Ratio of Outside Officers

The Audit & Supervisory Board comprises three Audit & Supervisory Board Members, including two Outside Audit & Supervisory Board Members. In accordance with the audit policy, etc. it has formulated, Audit & Supervisory Board Members attend meetings of the Board of Directors, Management Meetings, the Board of Executive Officers, and other key meetings, and carry out audits such as by learning from Directors and other personnel about the status of execution of their duties and inspecting documents whereby important decisions were made, etc. In addition, it collaborates with the Internal Auditing Division as necessary to gather appropriate information before conducting audits.

-

The Nomination and Compensation Advisory Committee

Chair Yoshiro Nagashima (Outside)

Number of meetings held during FY2024: 3

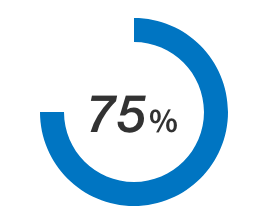

Attendance rate during FY2024: 100%Ratio of Outside Officers

The Nomination and Compensation Advisory Committee consists of four members: three Outside Directors and one Internal Director, with an Outside Director serving as the Chairperson. In response to consultations from the Board of Directors or the Representative Director, the Committee deliberates and submits recommendations regarding the appointment and dismissal (removal) of Directors and Executive Officers, the formulation of succession plans, and Director compensation.

-

Executive Officers

The Company has adopted the Executive Officers' system to achieve agility in business execution.

This system is prescribed in the Company's Articles of Incorporation, following the approval of shareholders. At present, 6 Executive Officers serve as the heads of operating divisions. They execute business efficiently and without delays with a view to accomplishing the medium-term management plan. -

Accounting Auditor

The Company’s Accounting Auditor is Deloitte Touche Tohmatsu LLC.

It conducts the Company's accounting audits from a fair and independent standpoint. -

Internal audits

The Company has set up an Internal Auditing Division. With Four staff members including its chief, it works independently of the execution of business to check if business operations and activities in individual segments comply with laws and ordinances, with the Articles of Incorporation and internal regulations, and with the Company's management policy and business plan and offers specific advice and recommendations in an effort to maintain the soundness of the Company. Internal audits are conducted in accordance with the annual plan. Their results are reported to representative Directors and Audit & Supervisory Board Members. Management thus understands the status of implementation and results, and Executive Officers, who are subject to auditing, carry out follow-ups.

Activities of the Board of Directors

In FY2024, the Board of Directors held a total of 13 meetings (including one extraordinary meeting). Each Board meeting lasted approximately 1 hour and 35 minutes. A wide range of issues were discussed, including the Succession Plan and other general governance issues, M&A, overseas strategies, and materiality, with an increasing number of issues being discussed from the consideration stage to the reporting agenda, resulting in effective discussions.

Main Agenda for the Board of Directors Meeting in FY2024

| Management Policy and Business Strategy | Discussions were held on the annual financial plan, materiality identification, overseas expansion, etc. Not only financial but also non-financial risks and opportunities in the market environment are identified and reflected in the linkage with each business strategy. Overseas, discussions were held regarding the India base established in April 2025 and initiatives in the ASEAN region. |

|---|---|

| (Group) Governance | Along with the establishment of the Succession Plan Committee, we had a lively discussion regarding the development of next-generation leaders. We also discussed how to strengthen the governance of the group as a whole, including domestic and overseas affiliates that have implemented M&A in 2023. |

| Strengthening Human Capital | With the start of the new personnel system, we discussed monitoring the penetration of each system and strengthening development and training. The number of training programs for executives has actually increased, and the effectiveness of these programs and other issues were discussed. |

| Strategic Investments (M&A) | We discussed the M&A and other matters concerning Takashima Electric conducted in December 2024. among other communications. We will continue discussions on building synergies with grouped companies and monitoring investment results. |

| KANADEN DX | Discussions were held on the effectiveness of the core system, which was renewed in November 2024, and the progress of inside sales. Discussions will also continue regarding further use of digital marketing, including Ai, and internal penetration measures. |

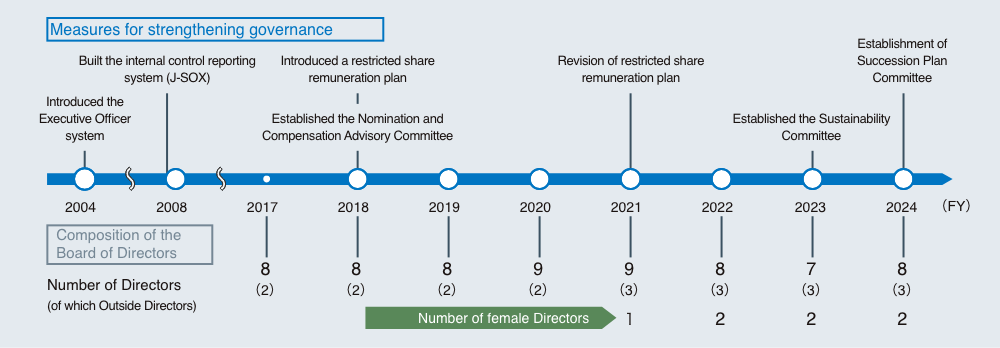

Changes in Corporate Governance

Directors/Audit & Supervisory Board Members

Directors

-

Futoshi MoriyaPresident (Representative Director)

- Apr. 1986Joined the Company

- June 2016Executive Officer and Senior General Manager, Factory Automation Division, the Company

- Apr. 2020Executive Officer and Senior General Manager, Kansai District Office, the Company

- June 2020Director, Executive Officer, and Senior General Manager, Kansai District Office, the Company

- June 2021Managing Director, Executive Officer, and Senior General Manager, Kansai District Office, and in charge of Branch office, the Company

- Apr. 2022Managing Director and Senior General Manager, Kansai District Office, and in charge of Branch office, the Company

- June 2023Senior Managing Director and Senior General Manager, Kansai District Office, and in charge of Sales Unit, and Solution Engineering Division, the Company

- Apr. 2024Senior Managing Director and Senior General Manager, Business Management Office, and in charge of Sales Unit, Solution Engineering Division, and ICT Promotion Division, the Company

- June 2025President and Representative Director, the Company (current position)

-

Harumi NakatakeManagement Director (Senior General Manager of Business Management Office)

- Apr. 1984joined Mitsubishi Electric Corporation

- Apr. 2018Senior General Manager, Chubu Branch, Mitsubishi Electric Corporation

- Apr. 2023Joined the Company

Senior Executive Officer and Senior General Manager, System Integration Division, the Company - Apr. 2024Senior Executive Officer and Senior General Manager, Building Facilities Division, the Company

- June 2024Director and Senior General Manager, Building Facilities Division, the Company

- June 2025Management Director, Senior General Manager of Business Management Office, the Company (current position)

-

Yoshiro NagashimaDirector (Outside, Independent)

- Apr. 1975Joined The Mitsubishi Bank, Ltd. (currently MUFG Bank, Ltd.)

- May 2002Regional Director, Toranomon Branch Office, MUFG Bank, Ltd.

- June 2004Representative Director and President, Tokyo Diamond Collection Service Co., Ltd. (currently MU Frontier Servicer Co., Ltd.)

- Oct. 2005Representative Director and Deputy President, MU Frontier Servicer Co., Ltd.

- June 2009Standing Auditor, NIPPON CARBIDE INDUSTRIES CO., INC.

- June 2016Outside Director, the Company (current position)

- June 2018Outside Director, ZENKOKU HOSHO Co., Ltd. (current position)

-

Yayoi ItoDirector (Outside, Independent)

- Apr. 1986Joined NIPPON TELEGRAPH AND TELEPHONE CORPORATION (currently NTT, Inc.)

- July 1988Joined NTT DATA Communications Systems Corporation (currently NTT DATA GROUP CORPORATION)

- Apr. 2008General Manager, Business Planning Promotion Office, Headquarter of Public System Business, NTT DATA Corporation

- Apr. 2016Joined Microsoft Japan Co., Ltd.

Senior General Manager, Headquarter of Enterprise Partner Sales Division - Feb. 2017Joined YAMATO HOLDINGS CO., LTD.

General Manager, Digital Innovation Promotion Office - Apr. 2018General Manager, Information Technology Strategy Department, YAMATO HOLDINGS CO., LTD.

- May 2019Joined UNIZO Holdings Company, Limited Managing Executive Officer

- Nov. 2020Joined SG SYSTEMS CO., LTD.

- Apr. 2021Executive Officer, in charge of Corporate Planning, SG SYSTEMS CO., LTD.

- June 2021Outside Director, SUMIKEN MITSUI ROAD CO.,LTD.

- June 2021Outside Director, the Company (current position)

- June 2023Outside Director, Japan Post Holdings Co., Ltd. (current position)

- June 2023Outside Director(Audit Committee Member), Nishimatsu Construction Co., Ltd. (current position)

-

Tomoe ImadoDirector (Outside, Independent)

- Oct. 2003Registered as an attorney with Daini Tokyo Bar Association

Joined Mori Hamada & Matsumoto - Apr. 2008Deputy Director, Economic Treaties Division, International Legal Affairs Bureau, Ministry of Foreign Affairs

- July 2010Joined OKUNO & PARTNERS

- May 2018Joined IR Japan, Inc. (current position)

- Jan. 2019Partner at Miura & Partners (current position)

- June 2020Outside Director, ZENKOKU HOSHO Co., Ltd. (current position)

- June 2022Outside Director, the Company (current position)

- Oct. 2023Executive Director, Tokyo Medical and Dental University (currently Institute of Science Tokyo) (in charge of governance reform)

- Oct. 2024Executive Director, Tokyo Medical and Dental University (in charge of legal affairs) (current position)

-

Takanori SugaiDirector (Senior General Manager of Kansai District Office)

- Apr. 1991Joined the Company

- June 2023Executive Officer and Senior General Manager, Building Facilities Division, the Company

- Apr. 2024Executive Officer and Senior General Manager, Kansai District Office, the Company

- June 2024Director and Senior General Manager, Kansai District Office, the Company (current position)

-

Nobuhiro KurodaDirector (Senior General Manager of Administration Division, In charge of Management Division)

- Apr. 1990Joined the Company

- Apr. 2022Executive Officer and General Manager, General Affairs and Personnel Office, the Company

- Apr. 2023Executive Officer and Senior General Manager, Administration Division

- June. 2025Director, Senior General Manager of Administration Division, In charge of Management Division (current position)

Audit & Supervisory Board Members

-

Kazuhiro TsukadaAudit & Supervisory Board Member (Outside)

- Apr. 1985Joined the Company

- Apr. 2015Executive Officer and Senior General Manager, System Integration Division, the Company

- June 2018Executive Officer and Senior General Manager, Facilities Operation Division, the Company

- June 2023Audit & Supervisory Board Member, the Company (current position)

-

Yoshikuni NoguchiAudit & Supervisory Board Member (Outside, Independent)

- Oct. 1990Joined Eiwa Audit Corporation (currently KPMG AZSA LLC)

- Apr. 1997Registered as a Certified Public Accountant

- June 2005Appointed Partner at KPMG AZSA LLC

- Sept. 2023Representative, Noguchi Certified Public Accounting Office (current position)

- June. 2024Outside Audit & Supervisory Board member, Daio Paper Corporation

- June. 2025Outside Director (Audit Committee Member), Daio Paper Corporation (current position)

Outside Audit & Supervisory Board Member, the Company (current position)

-

Chieko OgawaAudit & Supervisory Board Member (Outside, Independent)

- Apr. 2005Registered as a Certified Public Accountant

- Apr. 2006Joined Audit Corporation Nihombashi Office

- Sept. 2010Registered as a Certified Public Accountant in Washington state, USA

- Feb. 2014Registered as a Certified Tax AccountantApr. 2014General Manager, Ogawa Certified Public Accounting Office (current position)Apr. 2016Representative, Audit & Supervisory Committee Member, Toda City, Saitama Prefecture (current position)June 2017Outside Director (Audit & Supervisory Committee Member), Yorozu Corporation (current position)Apr. 2022Representative, Audit & Supervisory Committee Member, BOAT RACE TODA (current position)June 2023Outside Audit & Supervisory Board Member, Seven Bank, Ltd. (current position)

Skills Matrix of Directors

With regard to the composition of Directors, the Company selects individuals with extensive experience and knowledge in various fields, and seeks to improve the functioning of the Board of Directors, etc.

The main areas of specialist experience and knowledge for the Directors are as follows.Name (Age) Tenure

(Year)Position and responsibilities Main areas of specialist experience and knowledge Management Sales Technology Finance/

AccountingLegal

affairsInternational

businessHuman

resourcesDX Futoshi

Moriya

(62)5 President

(Representative Director)Harumi

Nakatake

(63)1 Management Director

(Senior General Manager of Business Management Office)Yoshiro

Nagashima

(73)9 Director(Outside) Yayoi

Ito

(61)4 Director(Outside) Tomoe

Imado

(50)3 Director(Outside) Takanori

Sugai

(56)1 Director

(Senior General Manager of Kansai District Office)Nobuhiro

Kuroda

(58)- Director

(Senior General Manager of Administration Division, In charge of Management Division)- * The professional experience and knowledge that each director has that are particularly strong and relevant to the Company's business are listed (maximum of 4).

- * Age and years of service are as of June 27, 2025.

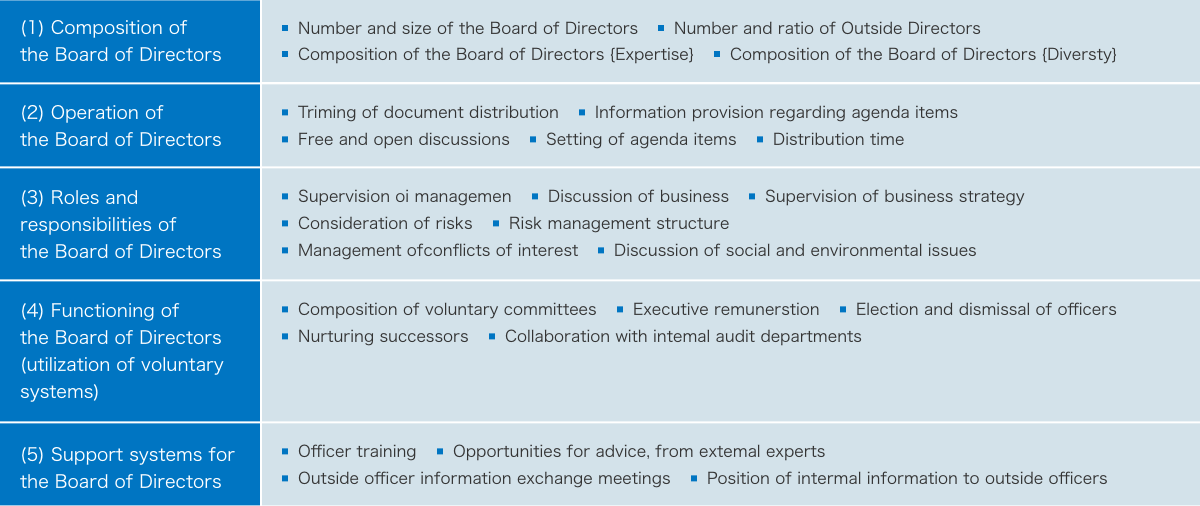

Evaluation of effectiveness of the Board of Directors

The Company seeks to heighten effectiveness of its Board of Directors and to strengthen its corporate governance. To such ends, it has the Board of Directors discuss and consider matters upon having administered written surveys in questionnaire format annually to its Directors and Audit & Supervisory Board Members.

Implementation approach: Questionnaire format; Implementation date: March of each year; Evaluation method: Each evaluation category rated on a scale of 1 to 6

- Improvement

- Implementation of improvements based on initiative policy

- Survey

- Questionnaires administered to all Directors and Audit & Supervisory Board Members

- Analysis

- Evaluation and analysis of survey questionnaires

- Deliberation

- Initiative policy determined upon discussion among the Board of Directors

Questionnaire Items

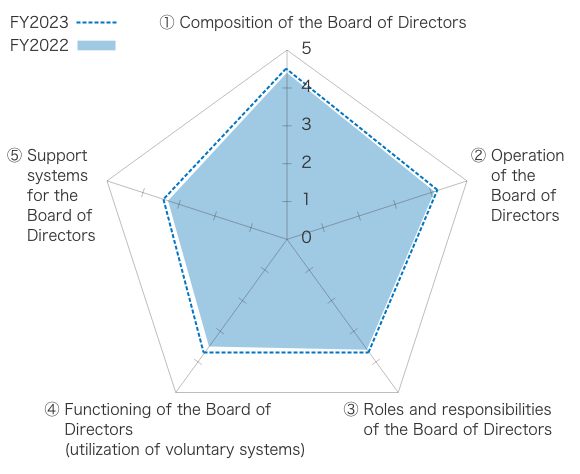

Analysis of Effectiveness in FY2024

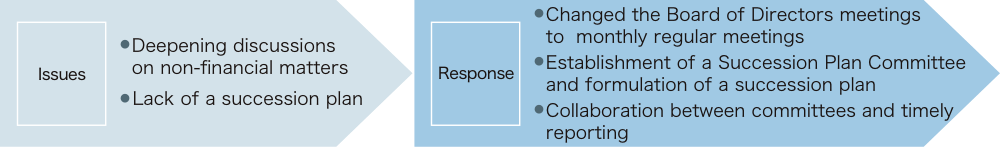

In the effectiveness evaluation conducted in 2024, the average rating was 3.8 out of 6 (0-5), indicating that the Company's Board of Directors is generally effective. Improvements since last year include the evolution of the Succession Plan Committee's efforts established in 2024, enhancement of the content of internal information provided, and acceleration of sustainability-related efforts through the identification of materialities.

On the other hand, as issues to be addressed in the future, they mentioned increasing the ratio of outside directors in the future, utilization of external organizations, and group governance including overseas affiliates.

Issues and Responses Revealed by the Effectiveness Evaluation for FY2024

Efforts to Strengthen Group Governance

To strengthen group governance, which has been a challenge, we established the Affiliated Companies Section in October 2024, which is responsible for management of domestic affiliated companies. We are promoting the creation of a framework that includes the strengthening of inter-group cooperation and the structure of the management function by holding meetings of the management division for the entire Company group on a regular basis. We will continue to further strengthen our management and supervisory functions in line with changes in the business environment surrounding the Company's group.

Discussion between Outside Directors

Nurturing the Next Generation of Management

The Company considers the development of human resources that will contribute to the sustainable development of its business to be one of its most important management priorities, and has formulated a succession plan to develop a successor to the President and a next-generation leader development plan to nurture the next generation of executive officers. These two plans are structured to develop managers over the medium to long term, with the executive officers acting as the link between them.

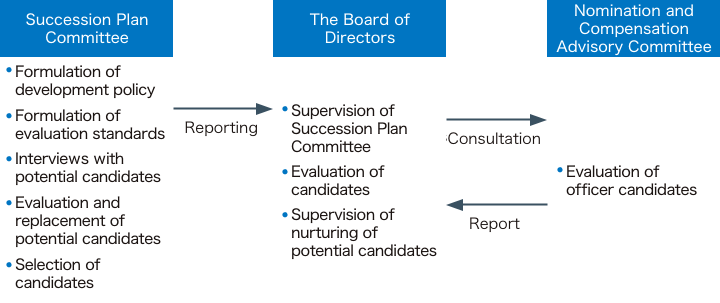

Succession plan

In order to identify and develop candidates to be the president (chief executive officer) in the future, we have established a Succession Plan Committee (chaired by an Outside Director) consisting of Outside Directors and the Representative Director. Candidates who meet the selection criteria will participate in a development program that will be held over a two-year cycle in principle, with a curriculum tailored to each individual based on the areas of “knowledge necessary for a manager,” “mindset required for a manager,” and “abilities required for a manager.”

The Succession Plan Committee will select from among the candidates the person who is most suitable to take on the management of the Company and report their selection to the Board of Directors. The Board of Directors will select the next chief executive officer after consulting with the Nomination and Compensation Advisory Committee.

Next-generation leader development plan

To identify and develop potential future executive officers, we conduct selection training programs tailored to each level: senior (division heads and deputy division heads), middle (department heads), and junior (section chiefs). For senior and middle management, we encourage them to advance their self-development by learning the mindset, perspective, and vision required to build businesses based on their own aspirations as next-generation leaders.They also learn the leadership mindset and actions expected of management leaders.

For junior-level employees, the focus is primarily on developing management literacy and leadership skills. This includes sending them to external training institutions to build new networks and broaden their horizons as next-generation leaders.Executive remuneration

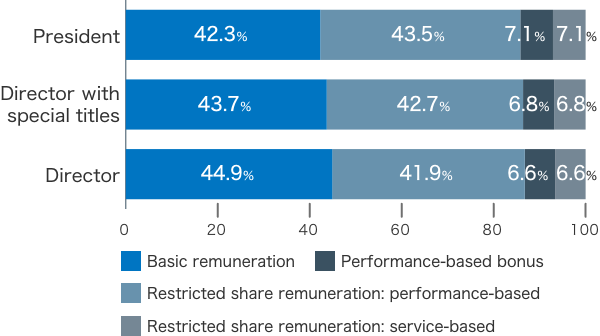

Executive remuneration at KANADEN consists of three elements: basic remuneration, which is fixed remuneration; the bonus, which is performance-based remuneration, etc.; share remuneration, which is non-monetary remuneration (restricted share remuneration). However, in view of the nature of their duties, only basic remuneration is paid to Outside Directors.

Determination process for remuneration

When it comes to the mix of different remuneration components for Directors, the higher a Director’s position, the higher the ratio of performance-based remuneration. We calculate amounts of basic remuneration for each Director, the extent of each Director’s contribution to earnings performance, allocation of bonus according to position, and allotment of share remuneration based on our internal regulations and within the range approved by the General Meeting of Shareholders.

We furthermore seek to ensure greater transparency by having the Board of Directors make decisions on matters such as the decision-making process and remuneration for individual Directors, in alignment with findings reported by the Nomination and Compensation Advisory Committee, chaired by an independent Outside Director.

1) Basic remuneration (monetary remuneration)

Basic remuneration for the Directors of the Company consists of fixed monthly remuneration at a level appropriate to their position, which is determined by a comprehensive view that takes into account objective remuneration survey data (such as industry, business category, net sales, market capitalization, and number of employees) obtained from specialized external third-party organizations, and the salary level of employees.

2) Performance-based remuneration (bonus)

The funding of performance-based remuneration, etc. at KANADEN is determined by profits generated in each fiscal year, and remuneration is paid as a bonus on a fixed date every year. In order to raise awareness of trends in performance, individual remuneration amounts are determined with reference to individual track records, which are computed in accordance with performance indicators set for each business segment. However, in the case of Directors for whom divisional performance cannot be evaluated, indicators for the entire company are applied.

3) Non-monetary remuneration (share remuneration)

Non-monetary remuneration at KANADEN is in the form of restricted share remuneration. The Company and eligible Directors enter into an allotment agreement for restricted shares, under which the eligible Directors are unable to freely transfer the allocated shares of the Company for a specified period of time. Share remuneration consists of two types of remuneration: performance-based restricted share remuneration with respect to which lifting of transfer restrictions is contingent on the extent to which indicators set forth the medium-term management plan have been achieved, and; service-based restricted share remuneration, which is contingent on an eligible Director continuing to hold the position of Director of the Company during the transfer restriction period. The Company will acquire such common shares without compensation in the event that the Company fails to achieve the indicators of its medium-term management plan or any other event stipulated in the Restricted Share Allotment Agreement.

Total amount of remuneration for FY2023

Category Total amount of

remuneration

(Millions of yen)Total amount of remuneration by type

(Millions of yen)Eligible

Officers

(Persons)Basic

remunerationPerformance-

based bonusRestricted

share

remunerationPerformance-

basedService-

basedDirectors

(Of which Outside Officers)257

(25)115

(25)108

(-)16

(-)16

(-)9

(3)Audit & Supervisory

Board Members

(Of which Outside Officers)24

(12)23

(12)-

(-)-

(-)-

(-)3

(2)Total

(Of which Outside Officers)281

(37)139

(37)108

(-)16

(-)16

(-)12

(5)- * The above amount paid includes one Director who retired at the conclusion of the 174th General Meeting of Shareholders held on June 28, 2024.

Policy on Strategically Held Shares

The Company annually reviews the necessity of holding shares for business operations and the appropriateness of holding them based on transaction conditions and other factors. We comprehensively consider holding risks, capital costs, and other elements to determine whether there is a valid reason for holding them at each board meeting. Following a thorough review, we have determined that shares lacking holding significance should generally not be retained, and we are proceeding with the reduction of strategically held shares.

Status of Strategic Shareholdings

The status of policy-held shares as of the end of March 2025 is as follows:

Number of Stocks Balance Sheet AmountListed Shares 31 stocks 3,316 million yen Unlisted Shares 18 stocks 151 million yen Standards for exercising voting rights for shares held

The Company exercises voting rights based on a comprehensive assessment of the reasonableness of proposals from investee companies, with a view to enhancing corporate value.

- TOP

- Sustainability

- Governance