Governance

- Basic Viewpoint Concerning Corporate Governance

- Nurturing the Next Generation of Management

- Evaluation of effectiveness of the Board of Directors

- Executive remuneration

Basic Viewpoint Concerning Corporate Governance

We are enhancing our corporate governance system, recognizing that strengthening corporate governance is one of the most important management tasks for laying a foundation to achieve sustainable growth of the KANADEN Group, increase its corporate value over the medium to long term, and fulfill its responsibilities to its diverse stakeholders.

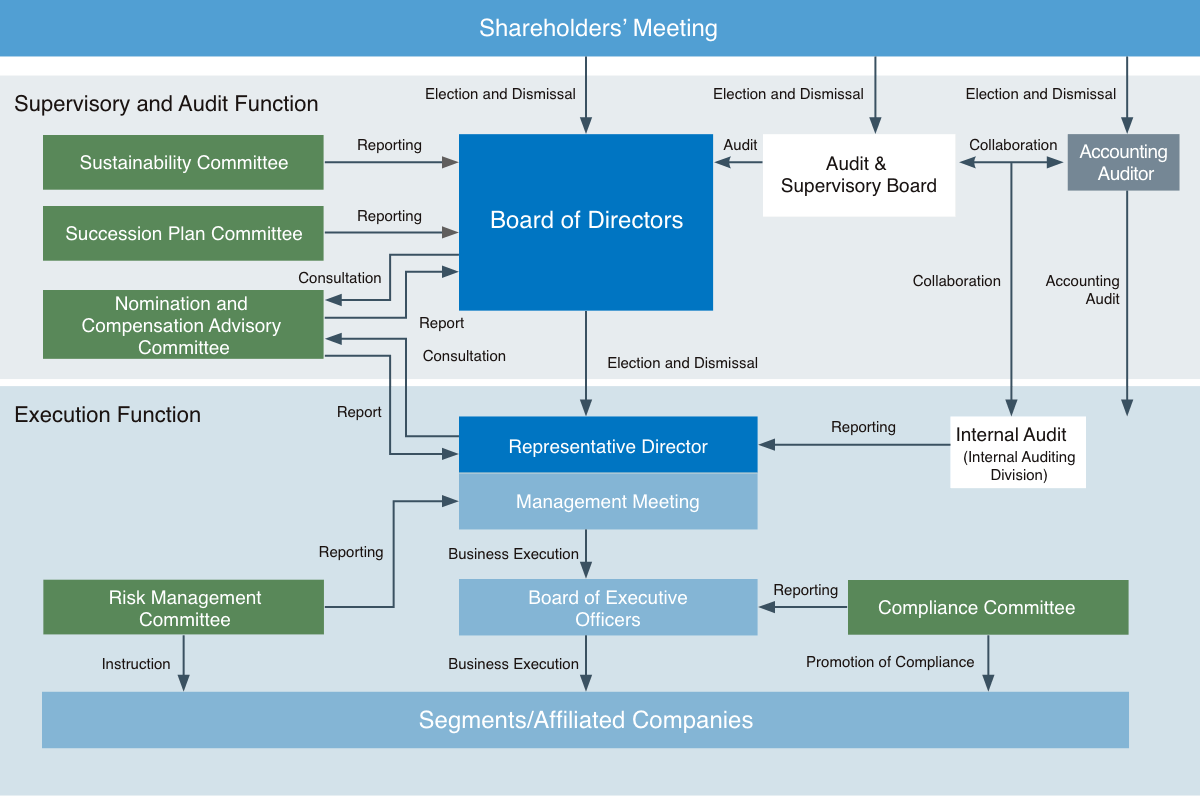

Corporate Governance System

-

The Board of Directors

Chairperson Nobuyuki Motohashi

Number of meetings held during FY2023: 12

Attendance rate during FY2023: 99%Ratio of Outside Officers

The Board of Directors consists of eight Directors, including three Outside Directors, in order to ensure swift and appropriate managerial decision- making. It holds ordinary board meetings each month and extraordinary board meetings as needed. In addition, we are increasing the opportunities to be able to grasp information related to topics through having Outside Directors participate in the meetings of the Board of Executive Officers and holding forums for facilitating information exchange.

-

The Audit & Supervisory Board

Chairperson Kazuhiro Tsukada

Number of meetings held during FY2023: 6

Attendance rate during FY2023: 100%Ratio of Outside Officers

The Audit & Supervisory Board comprises four Audit & Supervisory Board Members, including three Outside Audit & Supervisory Board Members. In accordance with the audit policy, etc. it has formulated, Audit & Supervisory Board Members attend meetings of the Board of Directors, Management Meetings, the Board of Executive Officers, and other key meetings, and carry out audits such as by learning from Directors and other personnel about the status of execution of their duties and inspecting documents whereby important decisions were made, etc. In addition, it collaborates with the Internal Auditing Division as necessary to gather appropriate information before conducting audits.

-

The Nomination and Compensation Advisory Committee

Chair Yoshiro Nagashima (Outside)

Number of meetings held during FY2023: 6

Attendance rate during FY2023: 100%Ratio of Outside Officers

The Nomination and Compensation Advisory Committee is chaired by an Outside Director and consists of four Directors, including three Outside Directors and one Inside Director. The Committee seeks to further enhance corporate governance by ensuring the fairness, transparency, and objectivity of procedures related to the appointment and dismissal of Directors and Executive Officers, formulation of succession plans, and the remuneration of Directors.

-

Executive Officers

The Company has adopted the Executive Officers' system to achieve agility in business execution.

This system is prescribed in the Company's Articles of Incorporation, following the approval of shareholders. At present, 10 Executive Officers serve as the heads of operating divisions. They execute business efficiently and without delays with a view to accomplishing the medium-term management plan. -

The Audit & Supervisory Board

The Audit & Supervisory Board comprises 4 Audit & Supervisory Board Members, including 3 outside Audit & Supervisory Board Members. In accordance with the audit policy it has formulated, Audit & Supervisory Board Members attend meetings of the Board of Directors, the Board of Executive Officers and other key meetings and learn from Directors and other personnel about the status of execution of their duties. They also carry out audits including the inspection of significant decision-making documents and the investigation of operations and assets at the Head Office and principal offices. If necessary, the board also audits related companies, for example, by asking them for reports on their operations.

-

Internal audits

The Company has set up an Internal Auditing Division. With five staff members including its chief, it works independently of the execution of business to check if business operations and activities in individual segments comply with laws and ordinances, with the Articles of Incorporation and internal regulations, and with the Company's management policy and business plan and offers specific advice and recommendations in an effort to maintain the soundness of the Company. Internal audits are conducted in accordance with the annual plan. Their results are reported to representative Directors and Audit & Supervisory Board Members. Management thus understands the status of implementation and results, and Executive Officers, who are subject to auditing, carry out follow-ups.

Nurturing the Next Generation of Management

The Company considers the development of human resources that will contribute to the sustainable development of its business to be one of its most important management priorities, and has formulated a succession plan to develop a successor to the President and a next-generation leader development plan to nurture the next generation of executive officers. These two plans are structured to develop managers over the medium to long term, with the executive officers acting as the link between them.

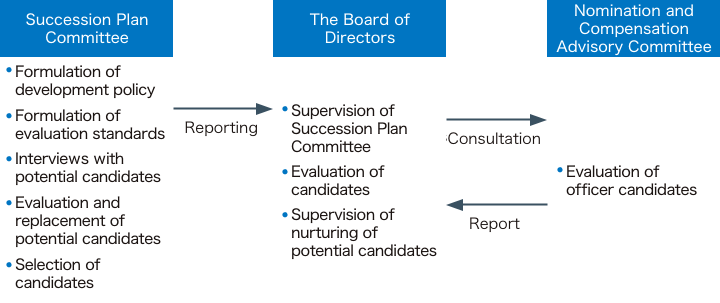

Succession plan

In order to identify and develop candidates to be the president (chief executive officer) in the future, we have established a Succession Plan Committee (chaired by an Outside Director) consisting of Outside Directors and the Representative Director. Candidates who meet the selection criteria will participate in a development program that will be held over a two-year cycle in principle, with a curriculum tailored to each individual based on the areas of “knowledge necessary for a manager,” “mindset required for a manager,” and “abilities required for a manager.”

The Succession Plan Committee will select from among the candidates the person who is most suitable to take on the management of the Company and report their selection to the Board of Directors. The Board of Directors will select the next chief executive officer after consulting with the Nomination and Compensation Advisory Committee.

Next-generation leader development plan

In order to discover and develop candidates who may become future Executive Officers from a wide range of people, we will implement selection programs at senior (division managers and deputy division managers), middle (department managers), and junior (section managers) levels.

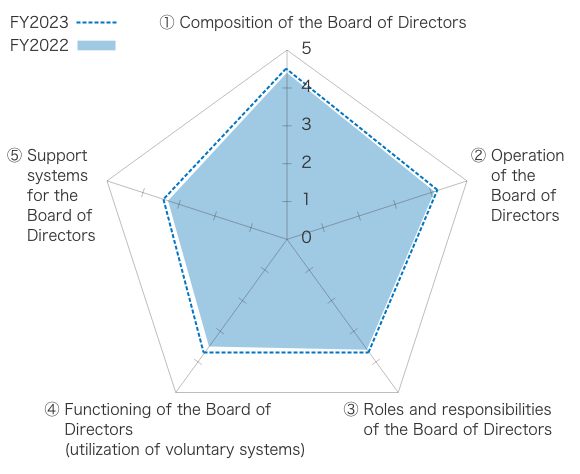

Evaluation of effectiveness of the Board of Directors

The Company seeks to heighten effectiveness of its Board of Directors and to strengthen its corporate governance. To such ends, it has the Board of Directors discuss and consider matters upon having administered written surveys in questionnaire format annually to its Directors and Audit & Supervisory Board Members.

Implementation approach: Questionnaire format; Implementation date: March of each year; Evaluation method: Each evaluation category rated on a scale of 1 to 6

- Improvement

- Implementation of improvements based on initiative policy

- Survey

- Questionnaires administered to all Directors and Audit & Supervisory Board Members

- Analysis

- Evaluation and analysis of survey questionnaires

- Deliberation

- Initiative policy determined upon discussion among the Board of Directors

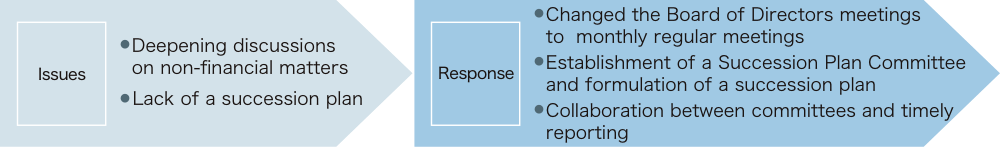

Issues and Responses Revealed by the Effectiveness Evaluation for FY2023

Initiatives to enhance effectiveness of Outside Directors

Our initiatives to enhance effectiveness of Outside Directors entail holding information exchange sessions attended by the Outside Directors and the Representative Director, and information exchange sessions attended by the Outside Directors and the Audit & Supervisory Board. We have strived to create an environment for deepening Outside Directors’ understanding of our operations and markets so they can provide more appropriate advice, which has entailed ongoing efforts to have them participate in our longstanding quarterly meetings of the Board of Executive Officers and also have them participate in the meeting of the Growth Strategy Committee, which is held in April.

In addition, we established a Sustainability Committee in May 2023 to promote sustainability initiatives, and established a Succession Plan Committee in June 2024 to promote successor development plans.

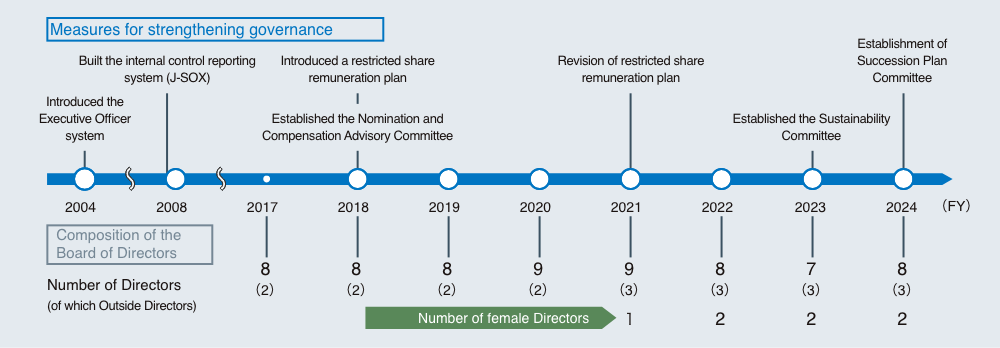

Changes in Corporate Governance

Analysis of Effectiveness in FY2023

The results of the effectiveness evaluation showed an overall trend toward improvement due to factors such as the establishment of the Sustainability Committee and an increase in the number of agenda items that were explained and discussed from the consideration stage.

In addition, there were opinions that discussion of non-financial issues such as social and environmental issues at Board of Directors meetings is still insufficient, that it is necessary to further strengthen group governance in relation to the execution of M&A, and that progress regarding nomination, remuneration, and succession plans should be shared appropriately. Going forward, I will strive to cooperate with each committee and provide appropriate reports to Board of Directors meetings.

Executive remuneration

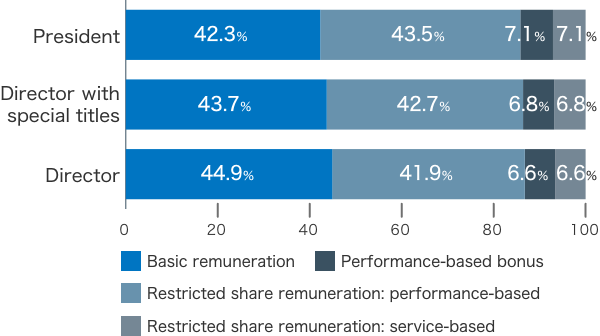

Executive remuneration at KANADEN consists of three elements: basic remuneration, which is fixed remuneration; the bonus, which is performance-based remuneration, etc.; share remuneration, which is non-monetary remuneration (restricted share remuneration). However, in view of the nature of their duties, only basic remuneration is paid to Outside Directors.

Determination process for remuneration

When it comes to the mix of different remuneration components for Directors, the higher a Director’s position, the higher the ratio of performance-based remuneration. We calculate amounts of basic remuneration for each Director, the extent of each Director’s contribution to earnings performance, allocation of bonus according to position, and allotment of share remuneration based on our internal regulations and within the range approved by the General Meeting of Shareholders.

We furthermore seek to ensure greater transparency by having the Board of Directors make decisions on matters such as the decision-making process and remuneration for individual Directors, in alignment with findings reported by the Nomination and Compensation Advisory Committee, chaired by an independent Outside Director.

1) Basic remuneration (monetary remuneration)

Basic remuneration for the Directors of the Company consists of fixed monthly remuneration at a level appropriate to their position, which is determined by a comprehensive view that takes into account objective remuneration survey data (such as industry, business category, net sales, market capitalization, and number of employees) obtained from specialized external third-party organizations, and the salary level of employees.

2) Performance-based remuneration (bonus)

The funding of performance-based remuneration, etc. at KANADEN is determined by profits generated in each fiscal year, and remuneration is paid as a bonus on a fixed date every year. In order to raise awareness of trends in performance, individual remuneration amounts are determined with reference to individual track records, which are computed in accordance with performance indicators set for each business segment. However, in the case of Directors for whom divisional performance cannot be evaluated, indicators for the entire company are applied.

3) Non-monetary remuneration (share remuneration)

Non-monetary remuneration at KANADEN is in the form of restricted share remuneration. The Company and eligible Directors enter into an allotment agreement for restricted shares, under which the eligible Directors are unable to freely transfer the allocated shares of the Company for a specified period of time. Share remuneration consists of two types of remuneration: performance-based restricted share remuneration with respect to which lifting of transfer restrictions is contingent on the extent to which indicators set forth the medium-term management plan have been achieved, and; service-based restricted share remuneration, which is contingent on an eligible Director continuing to hold the position of Director of the Company during the transfer restriction period. The Company will acquire such common shares without compensation in the event that the Company fails to achieve the indicators of its medium-term management plan or any other event stipulated in the Restricted Share Allotment Agreement.

Total amount of remuneration for FY2023

| Category | Total amount of remuneration (Millions of yen) |

Total amount of remuneration by type (Millions of yen) |

Eligible Officers (Persons) |

|||

|---|---|---|---|---|---|---|

| Basic remuneration |

Performance- based bonus |

Restricted share remuneration |

||||

| Performance- based |

Service- based |

|||||

| Directors | 261 | 110 | 119 | 15 | 15 | 8 |

| Audit & Supervisory Board Members |

20 | 20 | - | - | - | 4 |

| Of which Outside Officers | 32 | 32 | - | - | - | 5 |

- * The above payment amounts include one Director and one Audit & Supervisory Board Member who retired at the conclusion of the 173rd Ordinary General Meeting of Shareholders held on June 20, 2023.